Almost anyone who regularly flies will tell you that the customer experience isn’t what it used to be. Taking into account the increased threat of global terrorism, requiring tougher security checks and increased restrictions since 9/11, doesn’t fully explain the steady decline of a quality customer experience particularly in recent years. Most frequent flyers have their horror stories ranging from damaged and lost baggage to people being dragged from planes by law enforcement, to extra fees for “premium” seats or baggage. problems with the airline industry

Putting all of that aside, it still doesn’t explain the significant gap between the brand promise of airlines versus the reality of doing business with them. While some airlines are getting it right, experiencing satisfied customers, increased market share and profits — others aren’t. And they’re facing a turbulent outlook and competitive pressures on the ‘traditional’ airlines that are likely to continue for the foreseeable future. This rings particularly true for the more ‘traditional’ airlines.

Three Major Challenges – Problems With The Airline Industry

1. Customer Value Proposition vs. Customer Experience

Dr David Rock, a leading neuroscientist in the field of human-performance, writing about Professor Wolfram Schultz’s research on the brain’s reaction to expectations, notes the links between dopamine and the reward circuitry of the brain. Schultz found that when a cue from the environment indicates you’re going to get a reward, dopamine releases in response. However, if you’re expecting a reward and you don’t get it, dopamine levels fall steeply resulting in a feeling which is a lot like pain. Low levels of unmet expectations are something we all experience, resulting in falling dopamine levels. For example, expecting fast service at the store but finding a long queue results in a feeling frustration; in these circumstances, dopamine levels fall and individuals also experience a mild threat response.

Many of the traditional airlines promise a ‘premium’ type experience, with prices to match, but the actual customer experience doesn’t – rather, it is more like that of a low-cost carrier.

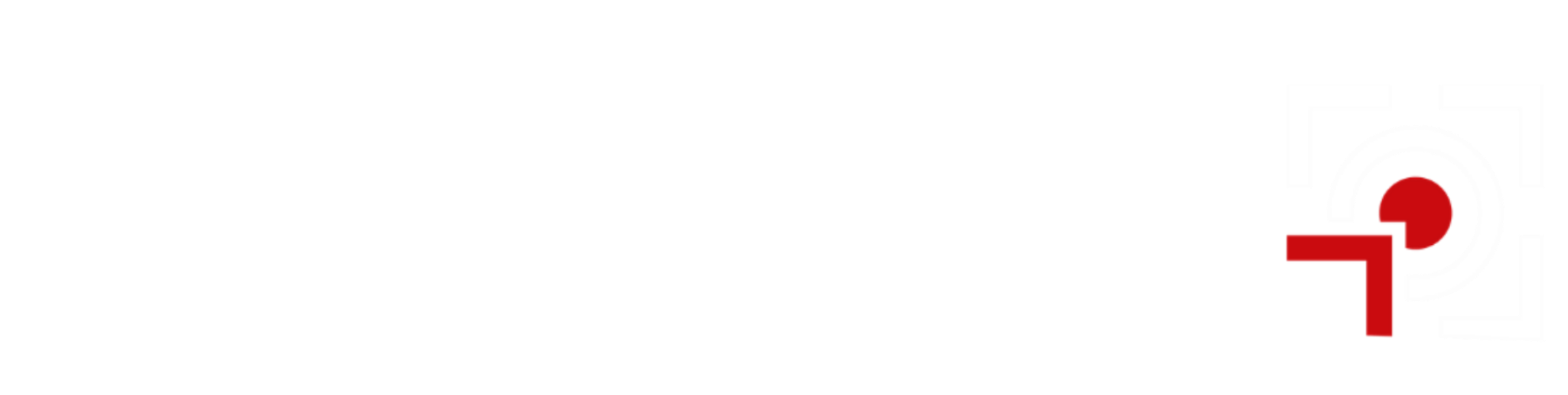

An example of this is the British Airways (tagline “to fly, to serve”) decision to introduce paid-for meals on its economy-class European and domestic flights, which it introduced from January 2017. Passengers now pay for snacks and drinks just as they would on BA’s low-cost competitors like Ryanair or EasyJet. Indeed, BA has gone on to announce that it will be reducing seat pitch (legroom) on European routes to match EasyJet’s 29”, so now even Ryanair will have more legroom than BA. US airlines have been following the same trend as the Consumers Union Seat Guru research shows. As people have grown bigger, seat width and legroom have gotten tighter.

These carriers are being squeezed from both ends by the low-cost airlines offering a reliable, low-cost ‘no-frills’ service on one side. And airlines like Singapore, Emirates, Qatar and Etihad differentiate on the quality of their product offering on the other side.

While the traditional airlines constantly look for ways to cut costs – often hitting the customer experience through reduced service or seat space — others seek to build a competitive difference that holds value for customers. The customer satisfaction rankings consistently show these airlines at the top with Emirates, Qatar and Singapore Airlines forming the top 3 in the in the 2016 World Airline Awards. Customers voted Emirates the World’s Best Airline. Qatar Airways ranked No. 2, awarded the World’s Best Business Class lounge and Best Airline Staff in the Middle East. Third place: Singapore Airlines won Best Airline in Asia, as well as the title for the Best Business Class Airline Seat.

1: Business class on Emirates 2: …On another well-known carrier

Where Jan Carlzon advocated looking for every customer touch point – or ‘moment of truth’ – to improve the customer experience, some airlines seem to be undertaking a similar exercise with the objective of cutting costs at the expense of the customer experience.

2. A Confusing, Over-Complicated Operating Model Impacts Customer Experience

The traditional carriers have very complicated operating models. These range from operating many different aircraft types to having tens of ticket classes that are confusing and unclear from the customer perspective. problems with the airline industry

Ryanair and Southwest Airlines have grown their business from including small regional airlines by offering differentiated features that attracted new customers as well as customers from competitors. Rather than focusing on organic growth by winning passengers onto their routes, the traditional airlines have focused on acquisition. This occurs through buying up competitors to either reduce route competition or build additional passenger numbers. The result? Although painted with the same livery, the airlines operate many different aircraft types. Sometimes, they use different systems and have crews of employees on different terms and conditions (or even cultures) based on the legacy airlines that have undergone either an acquisition or a merger. problems with the airline industry

This results in a highly variable customer experience — often ranging from very good to awful.

By operating multiple aircraft types maintenance costs increase and crews may not be interchangeable increasing costs and reducing flexibility. Also, when aircraft change, the seats you thought you’d booked may have changed. Recently on a transatlantic trip, the aircraft had to switch out due to a problem. But the replacement didn’t have the same number of seats. Thus, many passengers ‘bumped’ to a lower class than the ticket they’d bought. Then, agents informed these passengers they must sort out compensation from customer service when they got home. (The offices had closed for the night.) Contrast this with the low-cost carriers, who typically operate a single aircraft type — thereby greatly simplifying servicing costs and allowing smooth change-over in the event of changing aircraft.

Total Scheduled Passengers Carried (domestic and international)

| Rank | Airline | Passengers Carried (M) | ||||

| 1 | American Airlines including operations of US Airways | 146.5 | ||||

| 2 | Southwest Airlines | 144.6 | ||||

| 3 | Delta Air Lines | 138.8 | ||||

| 4 | China Southern Airline | 109.3 | ||||

| 5 | Ryanair | 101.4 | ||||

Source: https://www.airlineratings.com

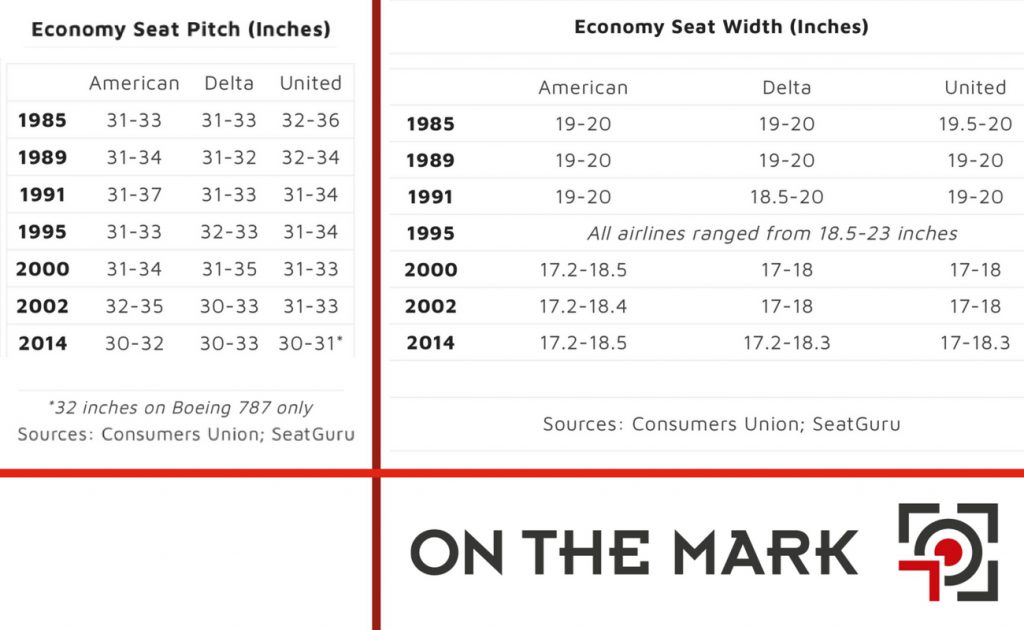

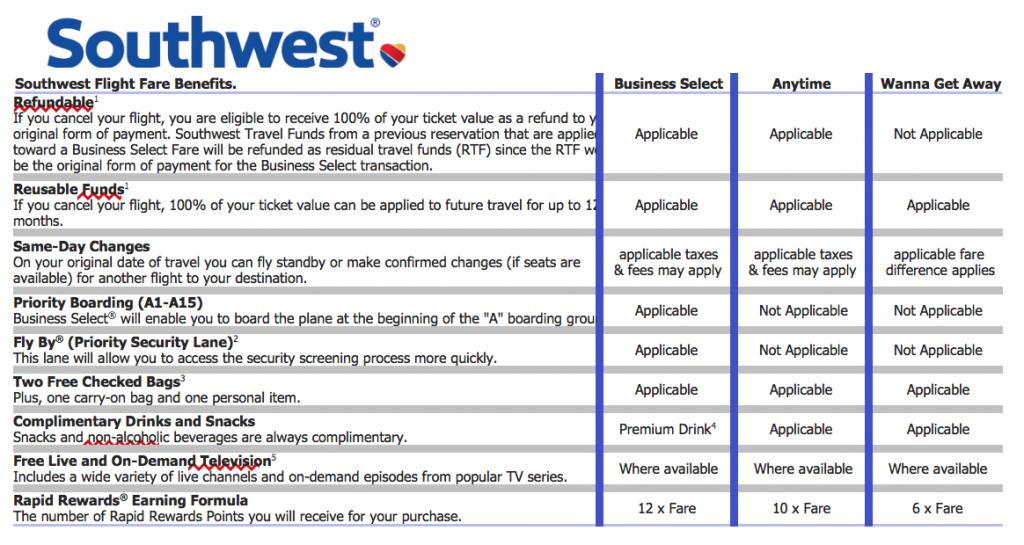

The low-cost carriers’ focus on simplification and standardisation follows through to fare structures, where customers typically find 2-3 options. problems with the airline industry

Southwest Fare Structure

EasyJet Fare Structure

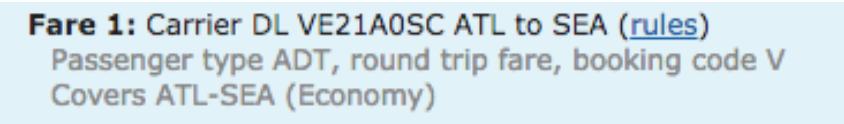

The traditional airlines have multiple fare types with different terms & conditions. For example – looking at standard IATA fare codes show there are three first class fare codes (F, A and P); J, R, D and I are business class fares; and Y, B, H, M, K, L, W, S, N, Q and O are economy fares.

On top of this, there are various types of selling class and restrictions as the example below shows:

problems with the airline industry

Example: Fare basis code WH7LNR tells us the following:

W — I have a W fare class ticket.

H — It’s a high-season ticket.

7 — I must book 7 days in advance.

L — Long-haul.

NR — The ticket is non-refundable.

As a frequent traveller wrote, “Deciphering fare basis codes takes practice and knowledge specific to the airline, as each one has its own style for writing codes.”

This results in additional costs for the airlines driven by customers contacting call centres trying to make changes. They then grow frustrated at ‘hidden’ costs and restrictions in the small print of terms and conditions.

3. Employee Experience

Leaders steadily strip away decision-making authority from front-line representatives. This means they can’t resolve many customer issues yet they bear the brunt of customer frustrations. It is not surprising that this can lead to poor behaviours as demonstrated by the recent case of an American Airlines employee hitting a female passenger with a stroller while forcibly removing it from her during a dispute over whether it would be allowed on the flight and then challenging another passenger to a fight when he complained about the behaviour. While there can never be an excuse for this sort of thing, it is perhaps understandable when faced with the constant stresses of enforcing confusing and opaque policies with no ability to resolve problems or even apply common sense.

After a recent business trip, flying back to London from a busy hub, we had secured seats on the last flight of the day. This flight is typically always full. The meeting we attended finished early, and we arrived at airport in time for an earlier flight with seats available. Neither the agent at the customer services desk nor in the frequent flyer lounge could help; it was the wrong ticket type. The result? Unhappy customer, the airline flying empty seats to London and missing the opportunity to sell seats on a flight with high demand; a lose-lose-lose scenario.

If this was your business, what would you do?

As Oscar Munoz, CEO of United, stated in relation to the notorious case of a passenger being physically dragged from a flight by police called by United staff, “It happened because our corporate policies were placed ahead of our shared values. Our procedures got in the way of our employees doing what they know is right.”

Contrast this with Southwest Airlines, who focus heavily on employee satisfaction explaining, “We believe that if we treat our employees right, they will treat our customers right, and in turn that results in increased business and profits that make everyone happy.” The airline has created a fun and inclusive culture, with core values. Furthermore, Southwest motivates employees to take pride in what they do, which often translates to going the extra mile for customers. The airline looks for employees with proactive attitudes, making every team member feel responsible for the success of their colleagues, creating a team-based environment that pushes employees to always do their best work — including getting planes from the gate into the air at record speed, driving customer satisfaction and loyalty. Singapore Airlines also emphasises and celebrates its employees from ground staff to air crew going the extra mile for customers. problems with the airline industry

So, what must happen?

1. Define a Clear Customer Value Proposition

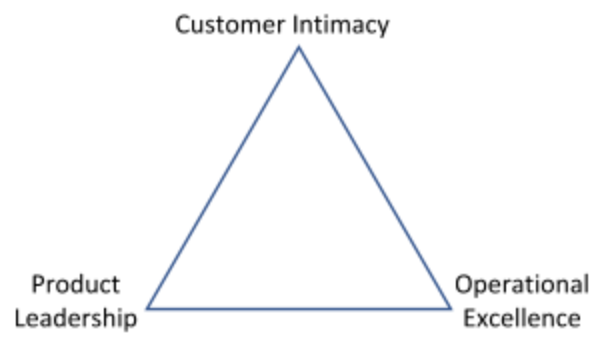

The work of Michael Treacy and Fred Wiersema demonstrates that organisations which consistently outperform their competitors choose a clear value proposition and rigorously build a business model to execute this strategic choice.

Airlines can choose to compete on price using Operational Excellence, product differentiation using product leadership or through deep customer relationships using Customer Intimacy. Whichever strategic position leaders choose requires trade-offs to focus on doing it well. The alternative involves remaining ‘stuck in the middle,’ as Michael Porter puts it.

Airlines can choose to compete on price using Operational Excellence, product differentiation using product leadership or through deep customer relationships using Customer Intimacy. Whichever strategic position leaders choose requires trade-offs to focus on doing it well. The alternative involves remaining ‘stuck in the middle,’ as Michael Porter puts it.

Operational Excellence

It is obvious that the likes of Southwest, Ryanair, Emirates or Singapore Airlines have chosen one of these value propositions. Competing on Operational Excellence means ruthlessly driving for standardisation and simplification. It also means outsourcing work to the customer using technology as an enabler. Any ‘extras’ are charged for but the main point of competitive difference is price.

Product Leadership

Product leadership requires consistent innovation and improvement of the product – think Apple. The objective? To create a difference with the competitors that customers find valuable.

Customer Intimacy

Customer intimacy requires building a deep relationship with customers such that the organisation could offer personalised solutions that feel unique. This value proposition is not normally used as a primary point of difference, as it’s difficult to build scale and sustainability of the advantage in the airline industry. However, it’s used as a secondary value offering in support of one of the other two (for example, through frequent flyer loyalty programs). problems with the airline industry

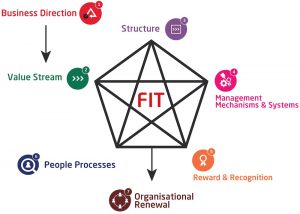

2. Align the Operating Model to Flawlessly Execute

Having a clear value proposition is not sufficient unless it is executed well. It’s important to ensure that the business model aligns with the value proposition.

Having a clear value proposition is not sufficient unless it is executed well. It’s important to ensure that the business model aligns with the value proposition.

Operational excellence organisations standardise processes wherever possible. (e.g., operate the same aircraft type to simplify maintenance and improve flexibility to move crew from aircraft to aircraft without the costs of additional training.) In addition, crew multi-task — executing cleaning/engineering checks when on the ground to keep costs down and ensure fast turnaround times. There is an emphasis on low overheads and technology is often used to drive standardisation and reduce costs.

(BELOW: EasyJet self-service baggage check-in)

Product leaders invest heavily in research and development – always looking for opportunities to improve the product and innovate.

Product leaders invest heavily in research and development – always looking for opportunities to improve the product and innovate.

Modern aircraft feature regular cabin upgrades and refurbishments. Crew are selected for their attitude. They’re encouraged and empowered to provide good customer service, solving problems at the ‘moment of truth’.

Business Class: From this… to this.

The experience surrounding the core product of the flight is also important. (For example, providing upscale airline lounge experiences to chauffeured limousines for business-class customers.)

(LEFT: Qatar Al Mourjan Lounge)

There’s an old saying, You can’t cut your way to growth. Competing effectively in the airline industry today requires consistently delivering against a clear customer value proposition. This equates to lines like Ryanair, Southwest Airlines, Singapore or Etihad – whether low-cost, product leadership or customer intimacy. This value proposition needs to be executed through an aligned operating model that consistently delivers. Anything less is hoping to be the ‘least worse’ choice.

To learn more about problems with the airline industry and how to tackle them, contact ON THE MARK. problems with the airline industry

Simon Davies is a Senior Consultant, and Mark LaScola is the Managing Principal at ON THE MARK. OTM is the leading global boutique organization design consultancy with offices in the USA and UK.

On The Mark’s experience and passion for collaborative business transformation that’s supported by pragmatism, systems thinking, and a belief in people is unparalleled. OTM has been in business for 27 years and is a global leader in organization design consulting.

roblems with the airline industry